The Moment Your Realize Your Money Isn’t Just Being Spent… It’s Decaying.

“CostRecon Solves This Problem Once And For All.”

Stop Losing Money From Past Financial Leaks, Capitalize On Household Savings Tools, And Uncover Your Path To Future Financial Savings.

– Reveal the “silent charges” draining you month after month

– Stop overpaying for insurance, utilities, and services.

– Turn every money saving decision into tracked proof.

– Store every policy, provider, account, and document for life.

– Use built-in reminders so savings don’t “decay” back into chaos.

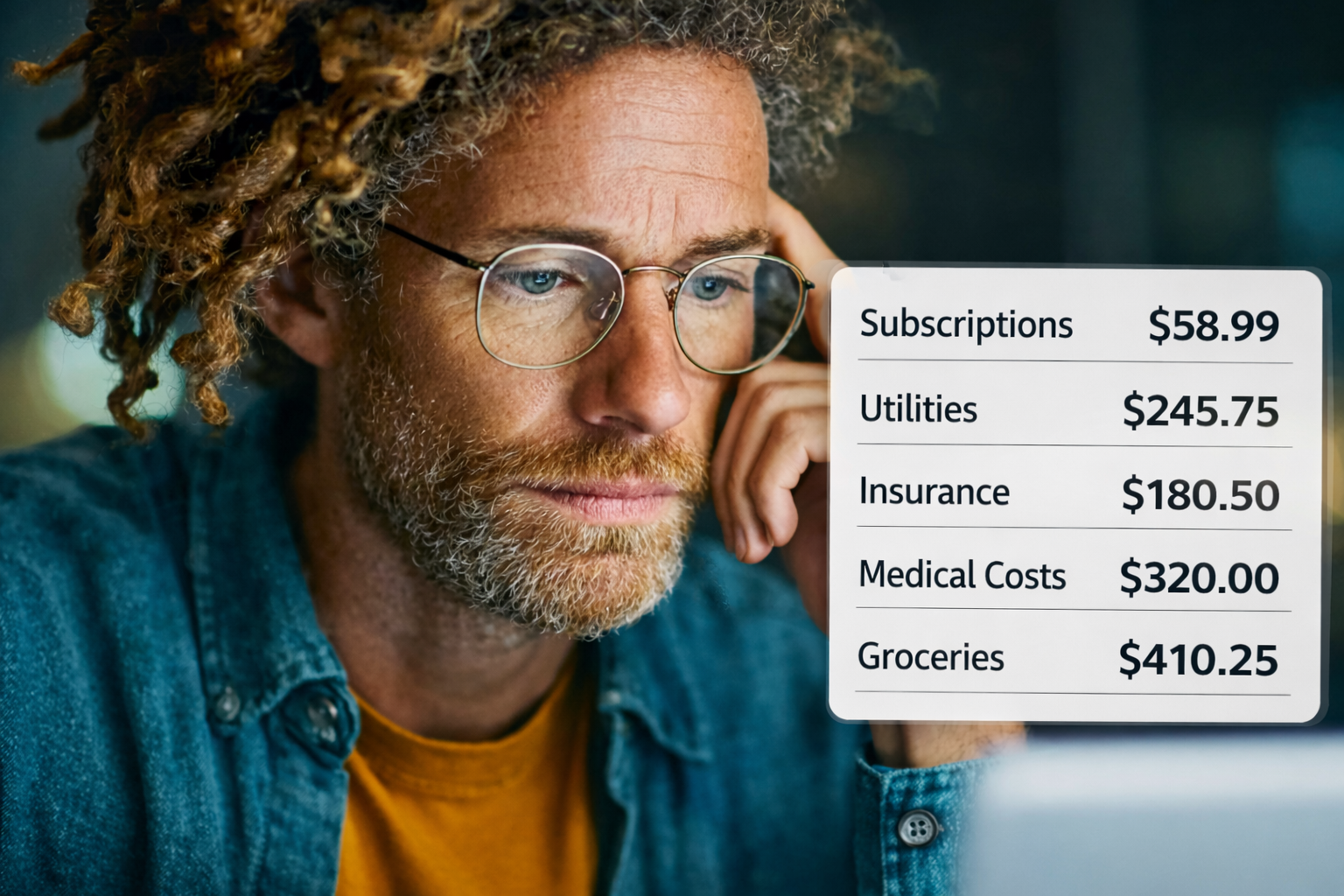

If you asked most people why their finances feel tighter than they should, they’ll give you familiar answers.

• Inflation.

• Unknown and Forgotten Subscriptions.

• Rising insurance costs.

• Utilities creeping up.

• Healthcare surprises.

All are true.

All are real.

But none of those are the actual problem.

These are just the underlying symptoms.

The real problem is quieter. More uncomfortable. And almost never named.

It’s this:

Most households make dozens of cost decisions every year.

But, almost none of those decisions are being saved, reviewed, or remembered.

You’re Handling Your Household Finances Completely Wrong And You Don’t Even Realize Why.

Most people imagine “wasting money” as something obvious.

Impulse buys.

Luxury splurges.

Bad habits.

But that’s not where the real damage happens.

The real losses happen when:

• You switch a service and forget why.

• You keep a plan because changing feels risky.

• You cancel something but can’t find the confirmation later.

• You stay insured “just in case,” but don’t know what’s actually covered.

• You pay for peace of mind — and slowly lose track of what that peace costs.

There is nothing that you see that’s broken.

There is nothing you hear that fails loudly.

So nothing feels urgent.

The “Set-It-And-Forget-It” Lifestyle = Money Quietly Draining Through Decisions You Never Revisit.

Here’s the uncomfortable truth:

Most people are not reckless with money.

They are uncertain with money.

So they default to “set it and forget it” ways of handling their finances.

-

Set and Forget internet.

-

Set and Forget insurance.

-

Set and Forget subscriptions.

-

Set and Forget utilities.

-

Set and Forget healthcare choices.

All these set and forget money leaks quietly compound into thousands of dollars over time — not because the decisions were wrong, but because no system exists to preserve them, evaluate them, or prove their value later.

-

This is not a budgeting problem.

-

This is not a discipline problem.

-

This is not a motivation problem.

This Is Literal “Financial Blindness” And…

No, More Budgeting Apps Alone Won’t Fix This.

Over the last decade, an entire industry has emerged to “help” people save money.

Apps that cancel subscriptions. Sites that compare insurance. Tools that negotiate bills. Dashboards that track spending.

They all promise relief.

And they all share the same flaw:

They treat financial decisions as single events, not clear compounding assets.

And they don’t help you make the best choices.

You cancel something. You switch something. You negotiate something. Then the tool disappears.

No memory. No record. No context. No proof.

Just another decision added to the pile — waiting to be forgotten.

Now…

What If You Could Start Seeing Everyday Cost Savings Across Multiple Categories Right Away?

What if household cost decisions were treated like they actually matter?

What if:

-

Every monthly charge was evaluated.

-

Every policy had a record.

-

Every service had context.

-

Every decision had documentation.

-

Every savings choice had proof.

-

Every year told a clear financial story.

Not to obsess.

Not to micromanage.

Not to optimize endlessly.

But to know.

To finally replace uncertainty with clarity.

The Missing Layer That Must Be Added To Your Everyday Household Financial Decisions.

Here’s the sentence that changes how you see this forever:

There is no system of record for household cost decisions.

-

Businesses have them.

-

Governments have them.

-

Hospitals have them.

The best run corporations track every contract, every vendor, every document, every justification.

Most households don’t.

So decisions vanish into memory.

Documents are scattered across inboxes and folders.

Mistakes repeat themselves quietly.

And people assume that’s just how it is.

But …

That’s Why You Need A Reliable System To Help You Cut Costs While Remembering What You Decided, When You Made Those Decisions — And Why.

Managing your household finances is a major task.

Most people assume the best way to handle things is to just bounce around from website to website, from app to app.

It’s can be confusing, so they keep using even more tools and more apps.

-

One for subscriptions.

-

One for insurance.

-

One for utilities.

-

One for groceries.

-

One for healthcare.

And for a moment, it feels productive.

But then:

-

A subscription forgets to get cancelled.

-

A premium skyrockets automatically.

-

A bill or rate increases by twice the amount.

What you really need is a command center that pulls everything together so you can maximize the power of the best money-saving tools that already exist.

This is the part no one explains.

A Central Hub That Allows You To Identify Where Money Is Escaping From So You Can Reclaim It.

Most people believe money problems ONLY come from one of three places:

-

Money Problem: not earning enough,

-

Money Problem: spending too much, or

-

Money Problem: failing to budget properly.

That belief is convenient.

It’s also wrong.

The real damage happens somewhere far less obvious —

In the slow, quiet accumulation of “small” recurring charges that were never meant to last forever.

-

A streaming service you signed up for during a free trial.

-

An insurance premium that increased “slightly” each renewal.

-

A phone plan with add-ons you never requested.

-

A utility bill that quietly normalized higher rates.

-

A software subscription tied to an old job, project, or habit.

Individually, none of these feel dangerous.

Collectively, they create a permanent drain on your finances.

And here’s the part that should make you angry.

These charges are designed to be ignored.

They are intentionally small enough to escape attention, automatic enough to avoid review, and recurring enough to quietly compound for years.

After Months Of Research We Finally Developed A Real Solution To This Growing Problem.

The tools that already exist are not the problem.

The missing layer is everything that happens around them.

-

The thinking before the decision.

-

The documentation during the decision.

-

The memory after the decision.

CostRecon exists to hold all those layers together.

Instead of asking you to replace what already works, CostRecon asks a simpler question:

-

What if you could use the best tools available — and never lose the intelligence they produce?

-

What if every decision left behind clarity instead of confusion?

-

What if savings weren’t just felt, but proven?

That’s the shift.

CostRecon Adds Multiple Layers Of Intelligent Features And Coaching Guides Around The Best Savings Tools To Unleash Their Full Benefits.

The tools that already exist are not the problem.

The missing layer is everything that happens around them.

-

The thinking before the decision.

-

The documentation during the decision.

-

The memory after the decision.

CostRecon exists to hold all those layers together.

Instead of asking you to replace what already works, CostRecon asks a simpler question:

-

What if you could use the best tools available — and never lose the intelligence they produce?

-

What if every decision left behind clarity instead of confusion?

-

What if savings weren’t just felt, but proven?

That’s the shift.

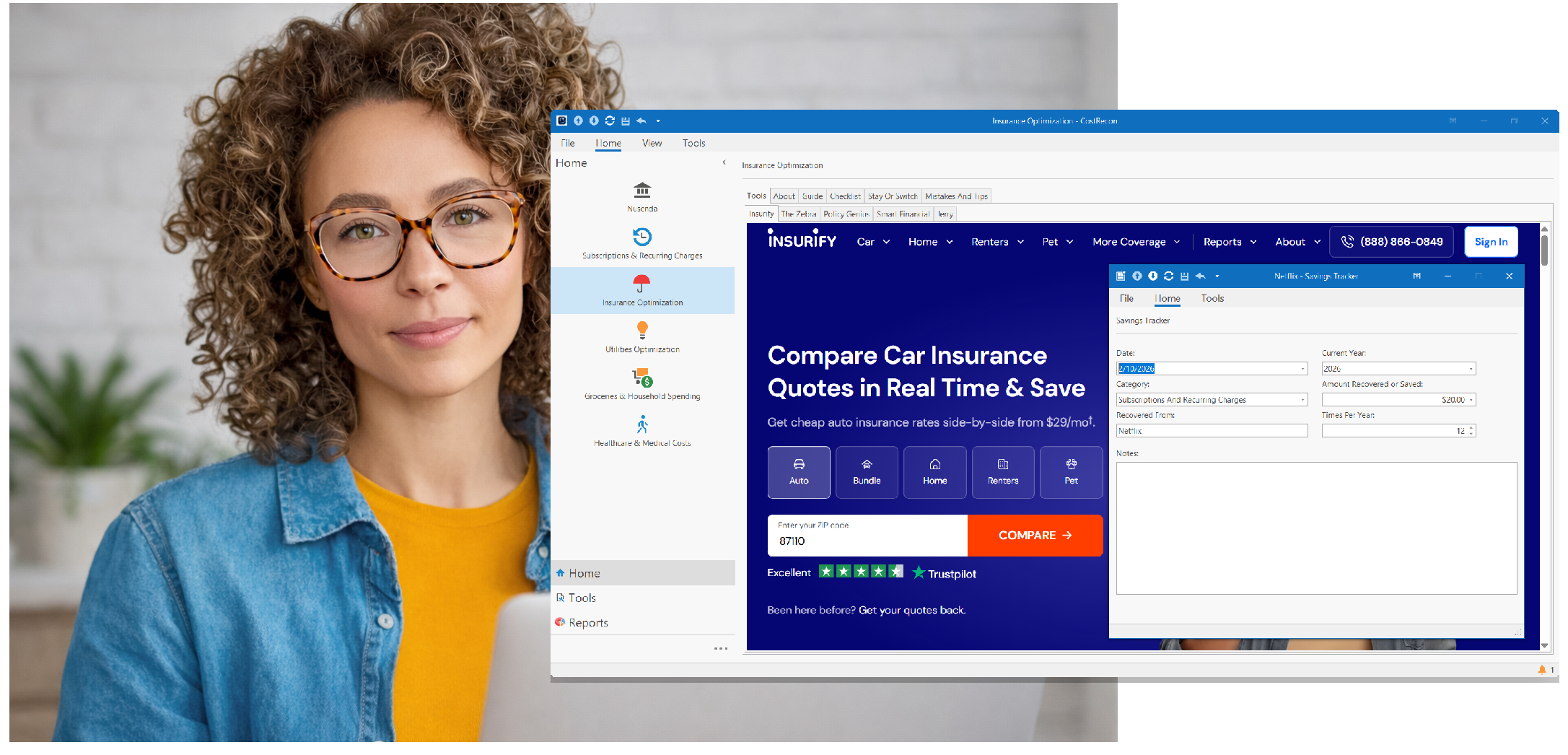

All The Right Tools, Guidance And Recources Are Built In And And Always Just A Click Away.

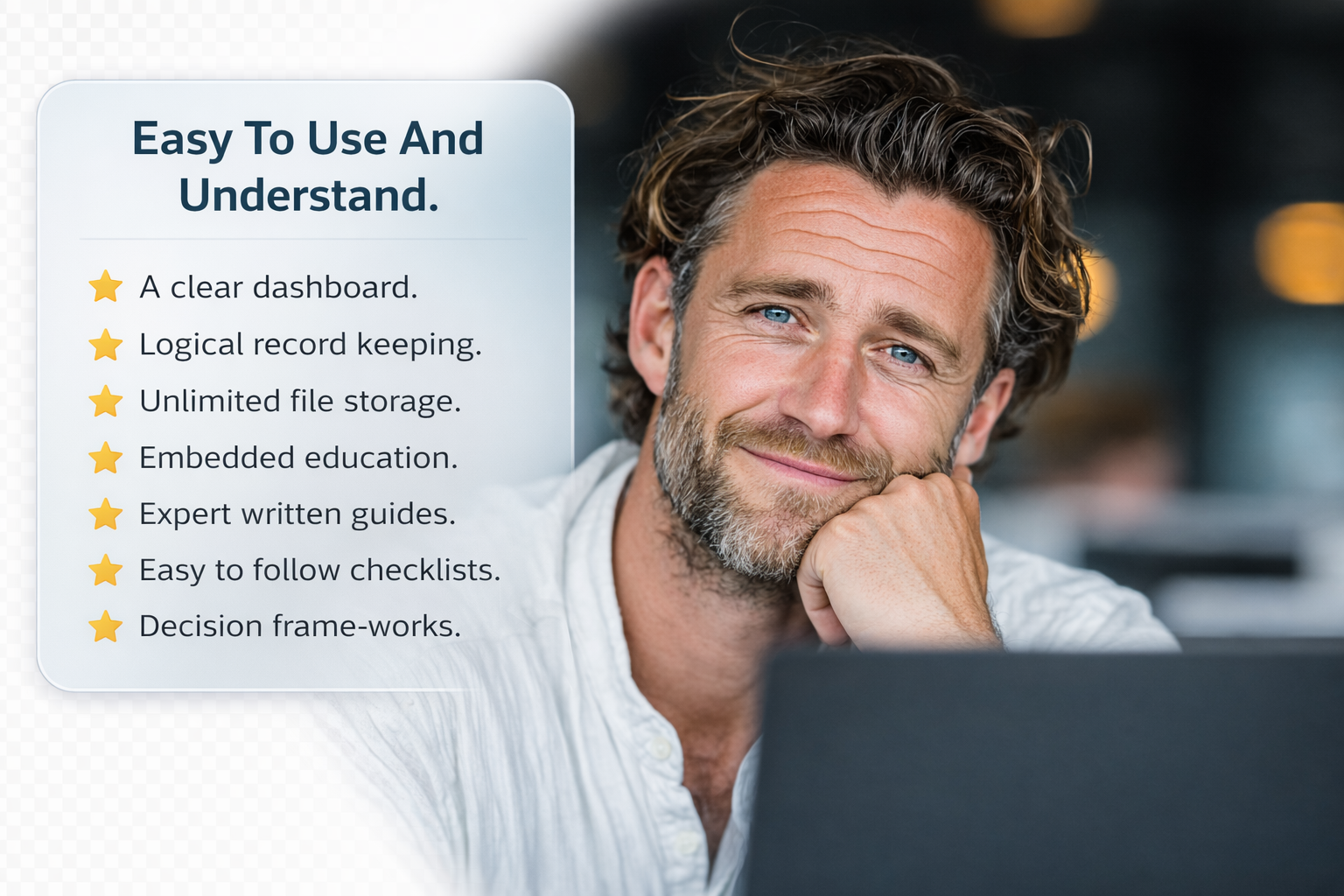

To be honest, while CostRecon is a powerhouse software, its layout and navigation are simple.

It has:

-

Logical record keeping.

-

Unlimited file storage.

-

Embedded education.

-

Expert written guides.

-

Easy to follow checklists.

-

Decision frame-works.

-

A clear dashboard.

All in plain language and a clean style.

But that simplicity is deliberate.

Because CostRecon isn’t trying to impress you with complexity.

It’s trying to remove the kind of complexity that quietly costs people money for years.

What you’re looking at is not an app that “does things for you.”

It’s a Household Cost Intelligence System — a place where decisions are made once, preserved correctly, and revisited only when it actually makes sense.

Yes, CostRecon Reveals All Your Undercover Hidden “Money Gaps”And Pulls Everything Together.

Cost Recon can help you see constant savings.

Because the real goal is to help you make educated financial decisions.

When you put that into place, the savings come naturally as a result.

-

Knowing what you’re paying for.

-

Knowing why you chose it.

-

Knowing what documents support it.

-

Knowing what you’ve already saved.

-

Knowing what is safe to change — and what is not.

That kind of clarity can’t be automated away.

It has to be preserved.

Costrecon Is Structured Like Software But Designed Like A Coach With Built-In Content Guides, Checklists, Decision Making Frameworks and More.

CostRecon doesn’t just organize your costs.

It strengthens your judgment.

Inside every category, you’ll find…

-

Embedded Guides.

-

Pros & Cons breakdowns.

-

Decision Frameworks.

-

Common Mistake alerts.

All built directly into the interface.

When reviewing insurance, you’ll get coached on what typically goes wrong before adjusting coverage.

When evaluating subscriptions, you’re reminded what most people forget to verify.

When considering switching utilities, you’re guided through timing, contract terms, and usage alignment.

This isn’t blog content. It’s contextual coaching.

-

Every checklist is designed to prevent expensive reversals.

-

Every framework removes emotion from high-impact decisions.

-

Every guide exists to ensure you understand what you’re choosing — before you choose it.

CostRecon doesn’t push constant action. It builds calm confidence about your finances.

Because the real advantage isn’t doing more.

It’s thinking clearly — every time it matters.

HERE’S PROOF.

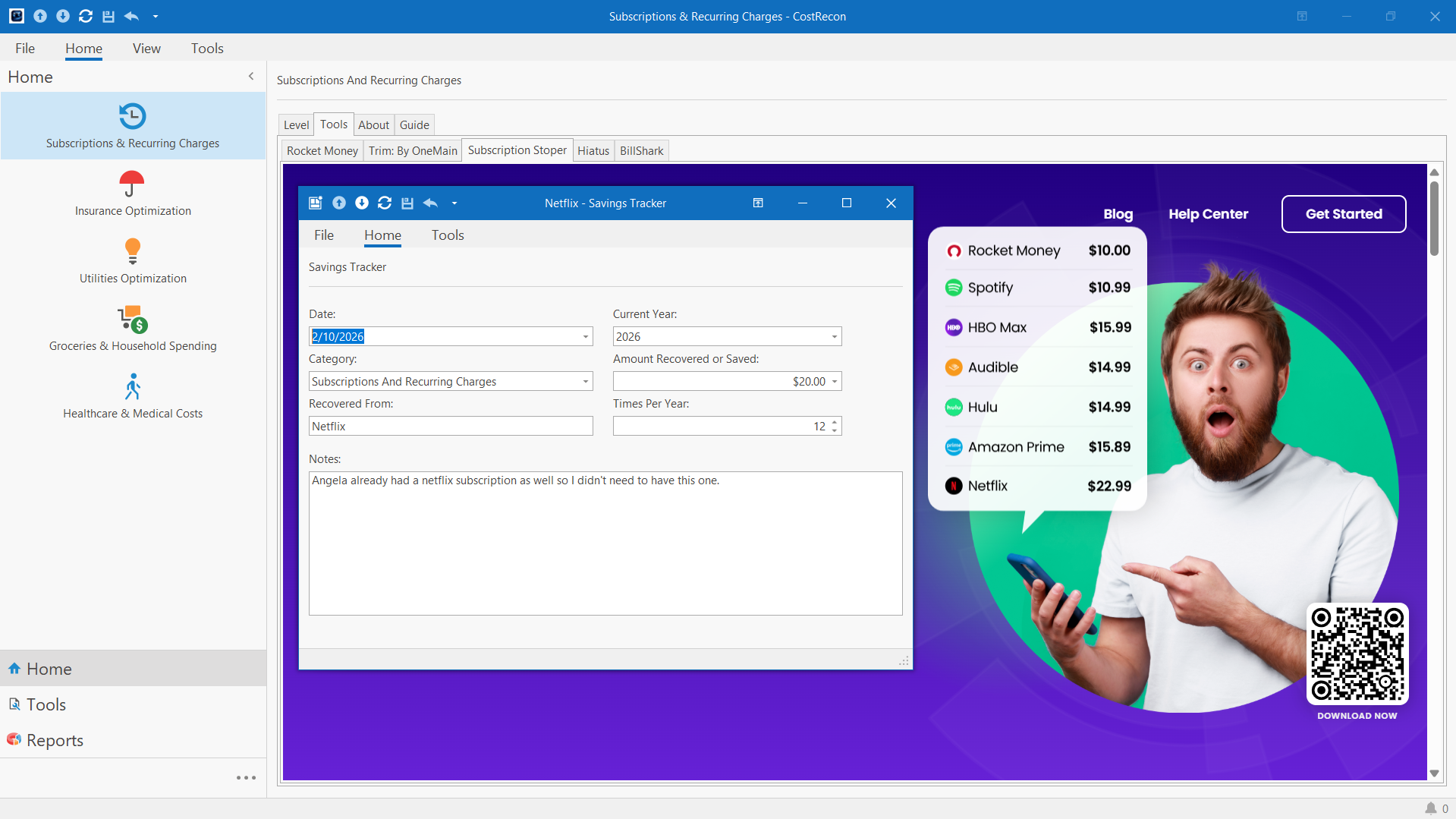

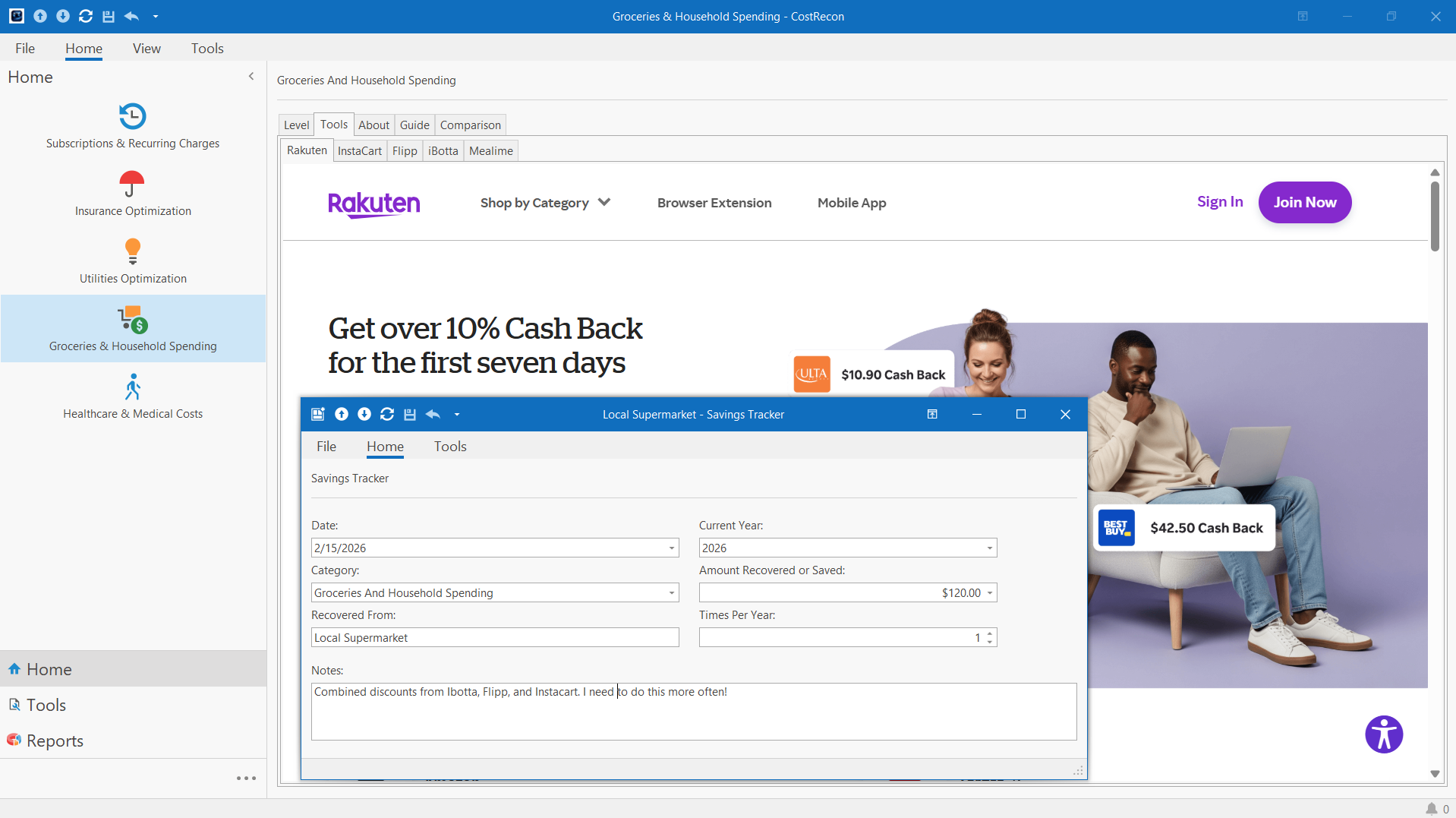

Nearly every recurring financial decision falls into one of five areas:

-

Subscriptions and Recurring Charges.

-

Insurance Optimization.

-

Utilities Optimzation.

-

Groceries and Household Spending.

-

Healthcare And Medical Costs.

Most people interact with these categories reactively.

After a bill shows up. After a rate changes. After a policy renews. After a charge looks unfamiliar.

But, instead of reacting, you’ll now operate from a single system that already knows what you’re dealing with.

Each category contains a curated set of already existing trusted tools.

So…

-

You’re not guessing which tool to use first.

-

You’re not bouncing between bookmarks.

-

You’re not wondering if you’re missing something important.

The system guides the order.

You supply the judgment.

Why Curating Existing Tools With Our Software Layered Around Them Is Our Strength, Not A Shortcut.

Some people assume originality means inventing everything yourself.

In practice, originality often comes from knowing what not to rebuild.

CostRecon does not try to replace tools that already do their job well.

It curates them deliberately.

That choice keeps CostRecon neutral.

-

It keeps it adaptable.

-

It keeps it focused on intelligence instead of control.

-

If a better tool emerges tomorrow, CostRecon can incorporate it without breaking the system.

-

The intelligence remains intact.

This Is Why Comparisons Fall Apart.

Once you understand what CostRecon is actually doing, comparisons start to feel wrong.

-

It’s not a budgeting app.

-

It’s not a subscription manager.

-

It’s not a bill negotiation service.

-

It’s not a document vault.

-

It borrows pieces from each category, but it doesn’t live in any of them.

Those tools handle moments. CostRecon handles continuity.

Why This Is Rare at the Household Level.

Businesses have systems of record because they cannot afford to lose memory.

Households lose money precisely because they don’t have one.

For decades, the assumption has been that this level of structure is unnecessary for individuals.

CostRecon challenges that assumption quietly.

Not by forcing complexity.

By offering clarity where it actually matters.

That clarity is not an accident.

It’s the product.

Let’s Take A Closer Look…

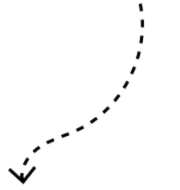

Yes, Reliably Save All The Info You Need For Quick Lookup And Future Savings Reviews.

This is where CostRecon becomes something most people have never had.

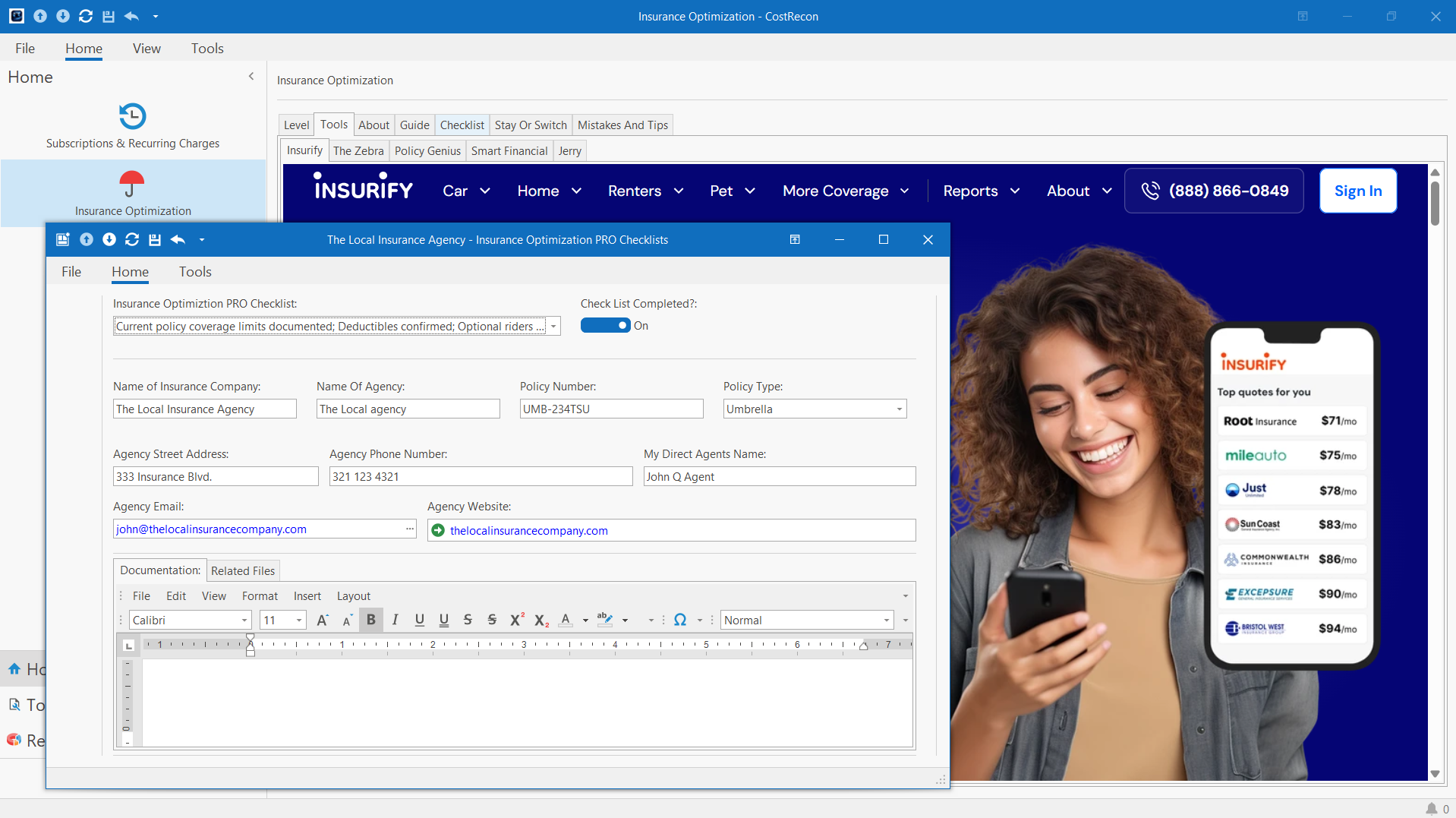

For the Insurance and Utilities, CostRecon includes record-keeping modules that let you store:

-

Policy details

-

Service plans

-

Provider or agency contacts

-

Account identifiers

-

Relevant notes

Each record lives in the context of the category it belongs to.

No more searching emails.

No more guessing which company you used two years ago.

No more re-learning the same information every time something changes.

The decision is preserved.

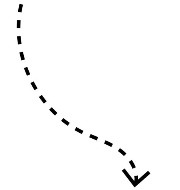

Plus, Easily Upload Files And Attach Them Alongside The Related Decisions And Records They Belong To.

Keeping files and documents organized and accessible is where most households fail quietly.

Policies get downloaded once.

Confirmations get buried.

Bills get saved “somewhere.”

CostRecon solves this by doing something simple and rare.

Making all your money-saving needs CONNECTED.

-

A policy document PDF lives with its policy record.

-

A cancellation confirmation text file lives with the service it canceled.

-

A bill or statement lives with the category that generated it.

You can still see all files in one place if you want.

But when you’re looking at a specific decision, you only see what’s relevant.

That’s how professionals manage information.

CostRecon brings that discipline into the household.

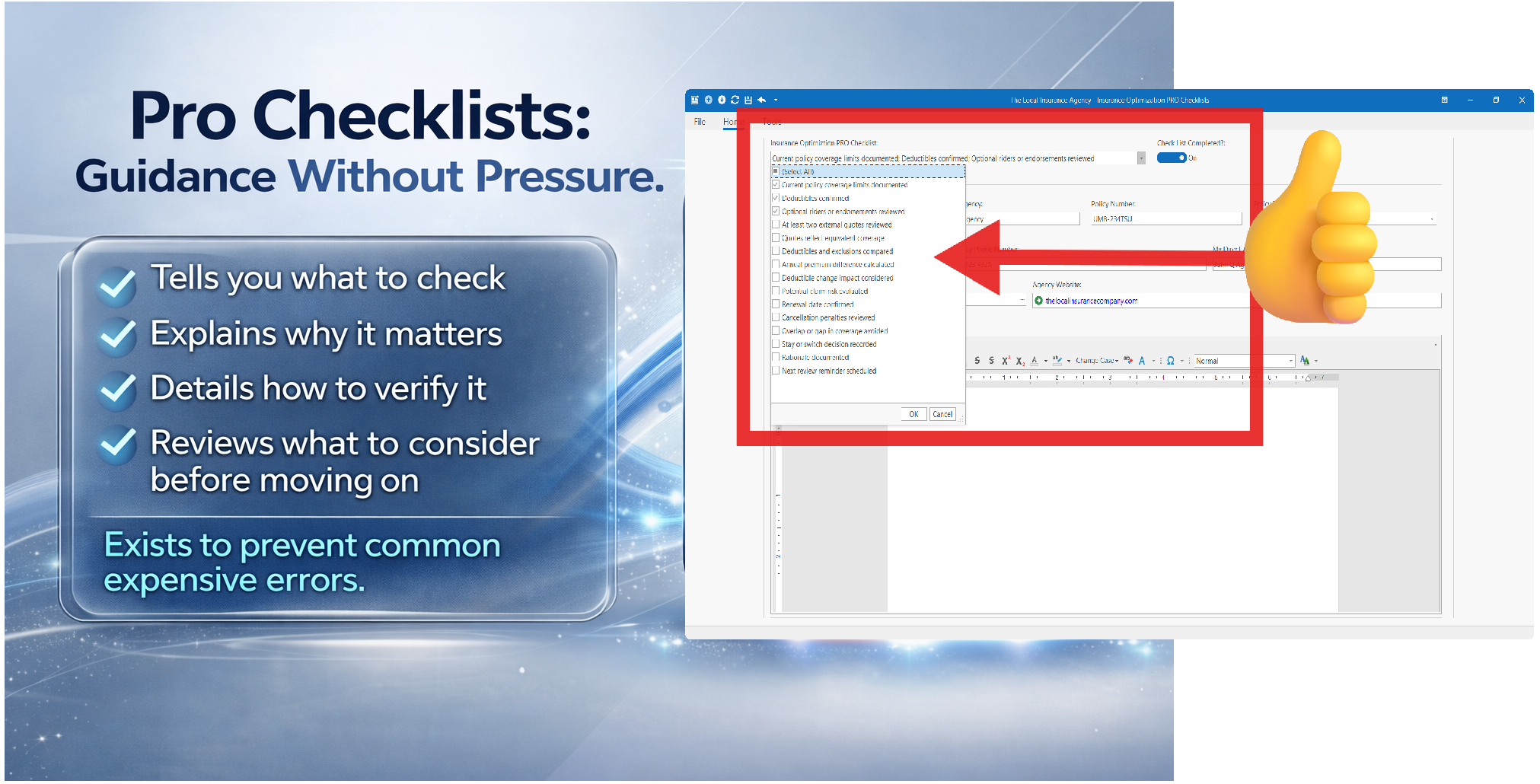

PRO Checklists Upgrade Included Prevents Expensive Errors And Leads You To The Correct Decisions.

We understand most people don’t just want advice.

You want reassurance that your’re not making a mistake.

CostRecon’s Pro checklists (for Insurance and Utilites Optimization) are designed for exactly that.

-

They don’t tell you what to choose.

-

They don’t push you to switch.

-

They don’t assume action is always better than staying put.

They walk you through:

-

What to check.

-

Why it matters.

-

How to verify it.

-

What to consider.

Each checklist step exists to prevent a common, expensive error.

The goal isn’t to get you busy or overloaded with activity.

The goal is confidence.

Yes, Add Quick Bits Of Data That Shows You Every Time You Make Money Saving Decisions.

Keeping files and documents organized and accessible is where most households fail quietly.

Policies get downloaded once.

Confirmations get buried.

Bills get saved “somewhere.”

CostRecon solves this by doing something simple and rare.

Making all your money-saving needs CONNECTED.

-

A policy document PDF lives with its policy record.

-

A cancellation confirmation text file lives with the service it canceled.

-

A bill or statement lives with the category that generated it.

You can still see all files in one place if you want.

But when you’re looking at a specific decision, you only see what’s relevant.

That’s how professionals manage information.

CostRecon brings that discipline into the household.

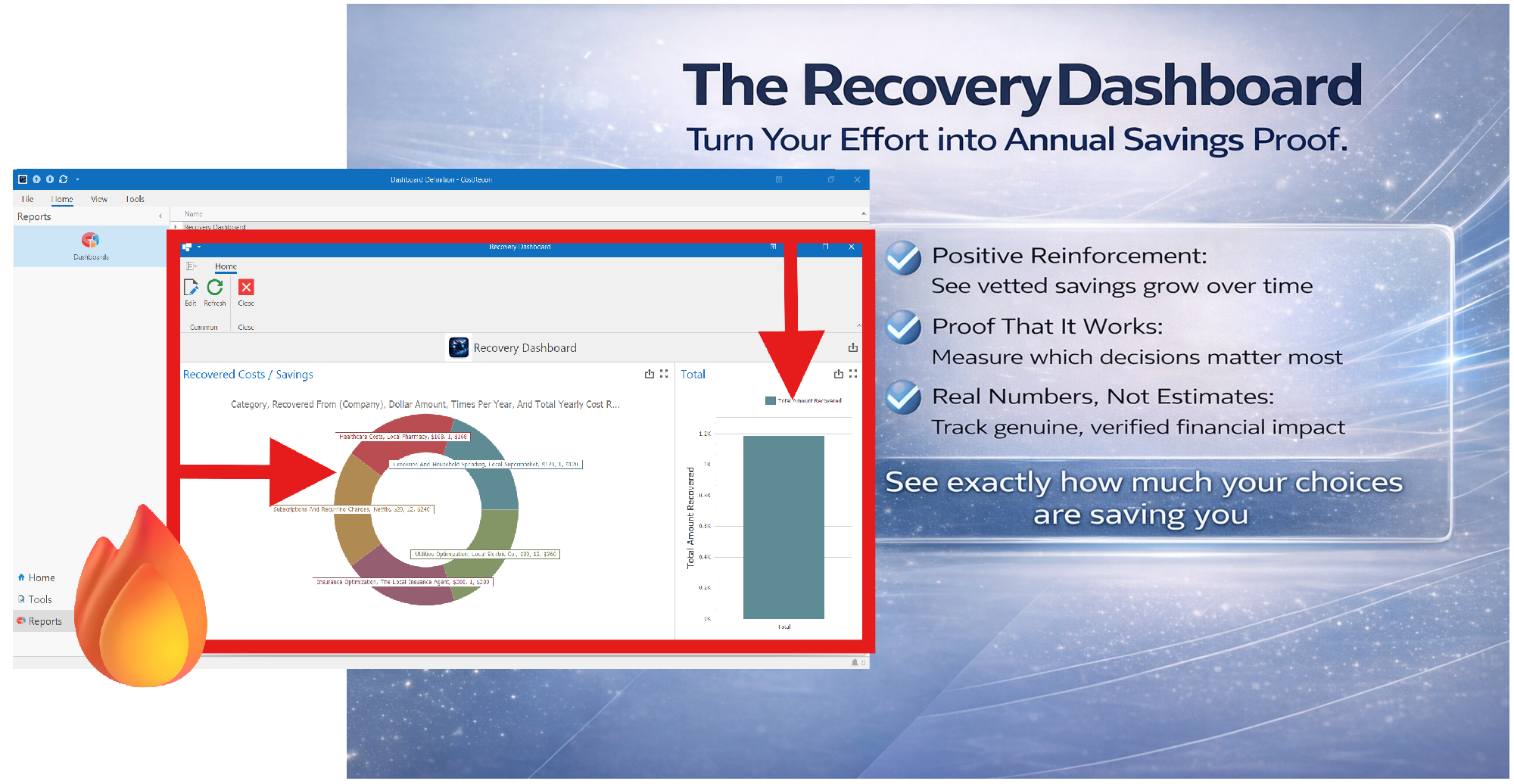

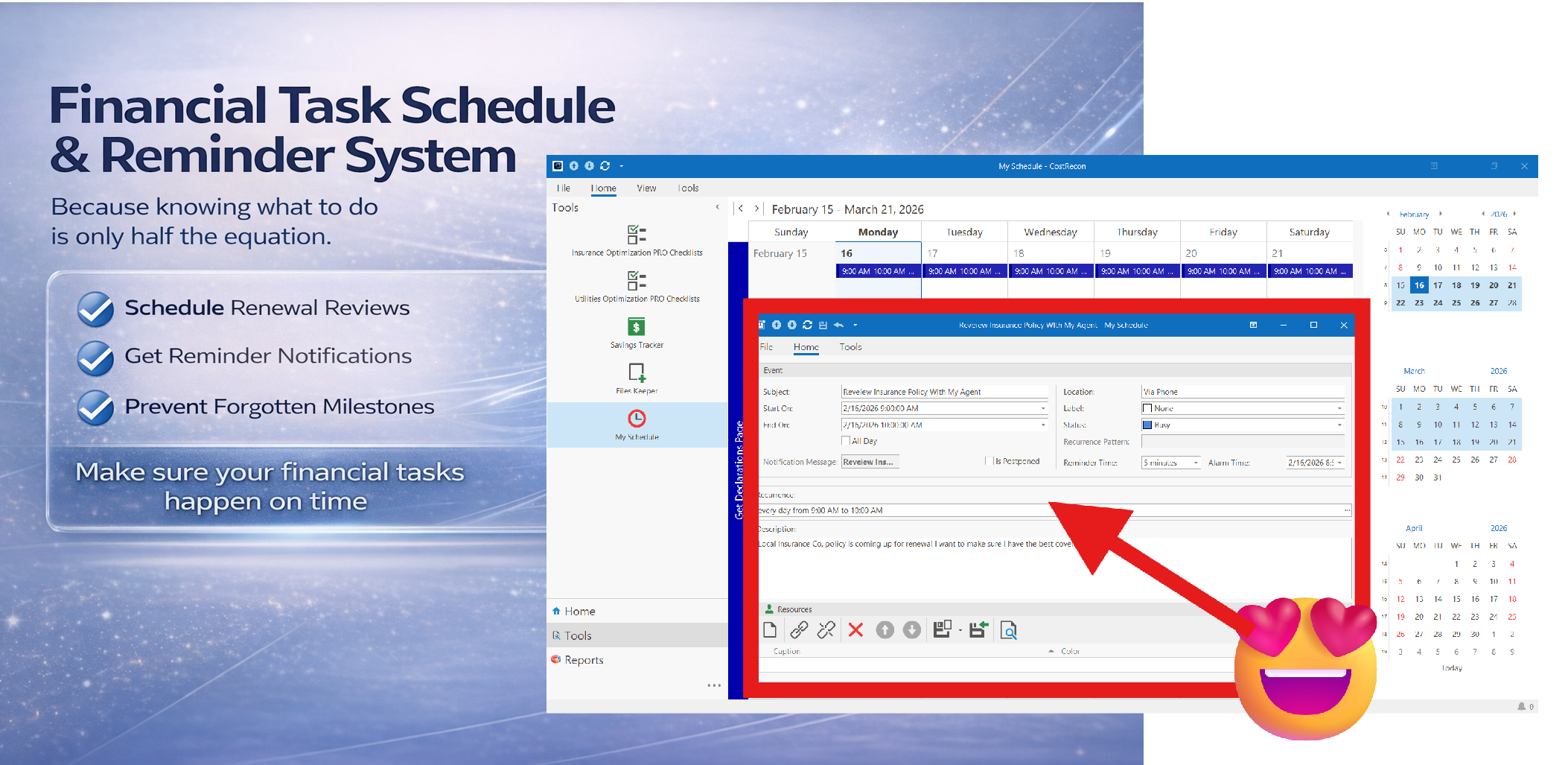

The Recovery Dashboard Will Prove You Are Successfully Creating Long-Term Gains Backed By Actual Dollars Saved Annually.

The Recovery Dashboard is where effort turns into evidence.

It is a real-time record of money you have already recovered, costs you’ve already reduced and already redirected back into your household.

Here, you are not looking at expenses. You are looking at victories.

Each action you log in CostRecon accumulates here and is translated into two powerful forms of reinforcement:

-

One, a categorical breakdown showing where your savings are coming from

-

Two, total recovery calculation showing how those individual decisions compound annually

These visualizations show you something most households never see:

Which category is quietly contributing the most to your financial stability.

The dashboard reveals patterns your memory never could.

And on the right side, the Total Amount Recovered becomes a number that changes your posture.

It does not just help you save money.

It trains you to recognize and compound intelligent financial decisions.

And that is where real long-term advantage is built.

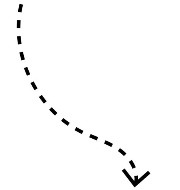

Yes, Add Quick Bits Of Data That Shows You Every Time You Make Money Saving Decisions.

Every financial action you take inside CostRecon can be paired with a scheduled follow-up:

It simply ensures that nothing important gets forgotten.

You can set up:

-

Insurance policy renewal reviews.

-

Utility promotion expiration dates.

-

Subscription audit check-ins.

-

Healthcare bill follow-up deadlines.

-

Annual cost comparison reviews.

-

You can schedule one-time events or recurring reminders.

-

You can document the purpose of the review.

-

You can attach context to the task so when the reminder appears, you know exactly why it matters.

This turns random financial tasks into a structured calendar.

You can seven set reminders that Pop-Up to alert you of your scheduled tasks.

The result is simple:

Your financial decisions become deliberate, scheduled, and repeatable.

CostRecon’s other features helps you optimize.

The Financial Task Schedule helps you maintain.

Together, they create a rhythm — and eliminate chaos — around your money.

Now…

Relax, This Gives You Back Money, Control And Time Saved Without The Stress And Overwhelm.

The fact is…

Most people underestimate how much time household costs actually consume.

Because it doesn’t all happen in one sitting — but in fragments.

-

Ten minutes here searching for a document.

-

Fifteen minutes there comparing plans you’ve already compared before.

-

An hour trying to remember why you chose a provider two years ago.

That’s exactly why CostRecon works.

It doesn’t eliminate decisions.

It eliminates re-decisions.

Once something is documented properly, you stop reopening it mentally.

You stop revisiting the same research.

You stop starting from scratch every time something changes.

The time savings don’t come from automation or fancy AI this and that.

The time and money savings come from final decisions.

Cost Recon Is Best Suited For People Who Clearly Understand The Following Points.

It’s for people who hate wasting money but hate chaos even more.

You don’t mind paying for things that make sense.

What bothers you is paying without understanding why.

CostRecon is built for that mindset.

It’s for people who don’t want to “optimize” their life every month.

You don’t want to renegotiate everything constantly.

You want to make good decisions once — and then move on.

CostRecon respects that.

It’s for people who think in systems even if they don’t know it.

You don’t have to be technical, financial, or enjoy spreadsheets.

But you do appreciate when things are orrganized, coherent, and calm.

CostRecon gives you that.

It’s for people who’ve been burned by forgetting.

Ever lost a policy document or missed the end of a discounted rate?

Ever second-guessed a past decision with no evidence?

Then you there’s a problem here.

CostRecon to help you solve it.

It’s for people who want proof, not promises.

If you care more about:

Verified savings than vague estimates.

Clear guidance and records over “simple suggestions.”

Knowing rather than hoping.

CostRecon gives you this evidence.

It’s for people who want to tip the scales in their favor.

If you want to stop losing track or where your money is leaking from.

If you want to always know that you are making the most sound decisions with your money.

Then this is what you need, now!

CostRecon was made just for you.

CostRecon Excels At Connecting The Best ONline Financial Saving Tools Into One… Central Platform.

CostRecon provides a platform where decisions don’t disappear.

A place where household finances stop being a series of disconnected moments and start becoming a coherent system.

That’s why CostRecon isn’t just another app.

It’s the layer that makes all the other ones finally make sense.

Instead of reacting, you’ll now operate from a single system that already knows what you’re dealing with.

Curated tools, not random links.

CostRecon does not attempt to rebuild services that already work.

It brings together best-in-class tools for each category — the same tools informed consumers already search for on their own.

Inside CostRecon, those tools are not isolated.

The difference is context. You now have a bridge to connect them in a real and useful way.

The Decision In Front of You.

At this point, you probably already know whether CostRecon makes sense for you.

Not because of a promise.

Not because of a feature list.

But because you can feel the difference between managing money reactively…

…and finally having a place where financial decisions stay put.

This is not a question of whether CostRecon can save you money.

You already know it can.

The real question is whether you want to keep operating without memory.

Common Questions, Answered Honestly.

“Isn’t this just a directory of other tools?”

No — and this is the most common misunderstanding.

A directory points you somewhere and disappears.

CostRecon stays.

The value isn’t the links.

It’s what happens around them.

CostRecon gives every decision a place to live, every document a context, and every savings action a trail of proof.

The tools you use may change. The intelligence you build does not.

That’s the difference between browsing and operating.

“Why can’t I just do this with spreadsheets or notes?”

You can — and many people try.

They build spreadsheets.

They create folders.

They bookmark sites.

They promise themselves they’ll keep it updated.

And for a while, it works.

Until life interrupts.

CostRecon exists because most people don’t fail due to lack of effort. They fail because manual systems decay.

They get skipped, forgotten, or abandoned the moment attention shifts.

This system removes the fragility.

It doesn’t rely on discipline.

It relies on structure.

“Why not just let apps handle this automatically?”

Automation is useful — until it removes understanding.

When things are handled entirely in the background, you lose:

Awareness

Judgment

Confidence

CostRecon doesn’t automate decisions away. It preserves them.

That way, when something changes, you’re not guessing. You’re reviewing.

That difference matters when the stakes are real.

“Will this make me obsess over money?”

No — it does the opposite.

CostRecon is designed to reduce mental load, not increase it.

Once decisions are documented and verified, you stop revisiting them. You stop wondering if you forgot something. You stop reopening the same questions every year.

The goal isn’t constant engagement.

The goal is calm.

“What if I don’t want to switch plans or providers?”

Then you won’t.

CostRecon is not a switching engine.

It doesn’t assume change is always better.

In many cases, the best outcome is confirming that staying put is the right choice.

The system supports that just as well.

Clarity is the win — not movement.

“Why hasn’t my bank or insurance company provided something like this?”

Because their incentives are different.

Banks focus on transactions.

Insurers focus on policies.

Utilities focus on billing.

No one is responsible for the household’s long-term decision memory.

CostRecon fills that gap without selling you products, steering choices, or creating conflicts of interest.

It works for you — not around you.

“Is this overkill for an average household?”

Only if forgetting, second-guessing, and repeating the same research feels acceptable.

CostRecon isn’t about complexity.

It’s about preventing quiet mistakes that compound.

Most households don’t need more advice.

They need fewer blind spots.

“How much time does this actually take to use?”

Less than you think — and less every year.

The first pass is about setup and documentation.

After that, CostRecon becomes something you visit occasionally, not manage daily.

You invest a little time upfront so you don’t keep paying for the same uncertainty over and over.

“How much time does this actually take to use?”

Less than you think — and less every year.

The first pass is about setup and documentation.

After that, CostRecon becomes something you visit occasionally, not manage daily.

You invest a little time upfront so you don’t keep paying for the same uncertainty over and over.

“What happens if I stop using it?”

Nothing breaks.

Your records remain intact.

Your files stay organized.

Your decisions don’t vanish.

CostRecon isn’t designed to trap you.

It’s designed to stand quietly in the background — ready when you need it.

“Who gets the most value from this?”

People who think long-term.

People who want fewer financial surprises.

People who value clarity over constant action.

People who prefer knowing over guessing.

If that describes you, CostRecon will feel less like software and more like something that should have existed already.

Today You’re Getting A System That Equals Much More Than The Sum Of Its Parts.

By now, you know CostRecon can help you see constant savings.

By now, you know the real goal is to help you make educated financial decisions.

When you put this type of system in place, savings come naturally as a result.

-

Knowing what you’re paying for.

-

Knowing why you chose it.

-

Knowing what documents support it.

-

Knowing what you’ve already saved.

-

Knowing what is safe to change — and what is not.

That kind of clarity is why you need to try CostRecon today.

Once you do, you’ll discover the price pales in comparison to the value you’ll get for a lifetime.

Pricing That Reflects What This Actually Replaces.

CostRecon is not priced like an app you try for a month and forget.

It’s priced like serious infrastructure.

Because that’s what it replaces.

It eliminates relying soley on:

-

Spreadsheets that slowly break.

-

Folders you never finish organizing.

-

Notes you can’t find when they matter.

-

Repeated research you’ve already done.

-

Decisions you keep reopening because nothing preserved them.

Most people don’t account for the cost of that friction.

But you’ll pay for it quietly – in time, uncertainty, and small “money mistakes” that compound year after year.

Now…

Just One Save From One Category Can Justify This Investment Right Now.

The price of CostRecon is intentionally lower than the cost of a single bad decision such as:

-

A missed insurance coverage gap.

-

A forgotten promotional rate.

-

A plan you stayed in too long because switching felt risky.

Avoiding just one of those usually justifies the entire investment.

Everything after that is upside.

This Is the Moment of Choice.